Insights

News about faculty and their research

As part of our mission to define the future of management, Dean Iyer has unified the School of Management around four distinct areas of focus:

- Business analytics

- Social impact of management

- Business of climate change

- Innovation, entrepreneurship and leadership

These strategic initiatives are integrated across academic areas and incorporated into the school’s programs, teaching, experiential learning, partnerships and research to help us realize our vision of a world of transformational leaders and organizations who change society for the better. The examples that follow demonstrate how our faculty are bringing new perspectives to these areas through their research.

On this page:

Reducing the carbon footprint of data centers

Ramesh

As data centers are expected to consume 8% of the world’s electricity by 2030, new School of Management research has discovered a strategy to conserve power in these IT behemoths — and optimize their data processing performance.

Published in Information Systems Research, the study found that using a mix of two different resource management strategies resulted in near-optimal energy efficiency under all workload conditions.

“Data centers consume a tremendous amount of energy because they generate heat, which requires cooling services, and when the servers communicate across racks, energy consumption goes through the roof,” says study co-author Ram Ramesh, professor of management science and systems. “The rise in energy costs coupled with the urgent need to reduce the carbon footprint together create an imperative for new approaches to achieve efficiency.”

The researchers collected nearly 3 terabytes of data from a supercomputing center over a one-month period, and analyzed the power consumption and heat load, and how those translated into total energy consumption on a second-by-second basis. They then developed a model that uses observations from previous time steps to predict how the total computing load and its distribution across servers would affect total energy consumption in a data center. Using this model, they discovered the optimal way to allocate computing resources for incoming jobs.

Their findings show that data center managers can reduce energy consumption 10-30% by consolidating jobs to as few servers as possible when workloads are high, and evenly distributing the workload across all servers when loads are low. And, it’s simple to find the transition point between the two strategies using their methods.

“When we focus on energy conservation while allocating computing resources, certain jobs can take longer to complete, so there is a tradeoff between minimizing energy consumption and optimizing job performance.” says Ramesh. “By attaining an efficient balance in this tradeoff, companies can reduce their environmental impact, complete jobs on time and save millions of dollars in energy costs each year.”

AI as a teammate

Bezrukova

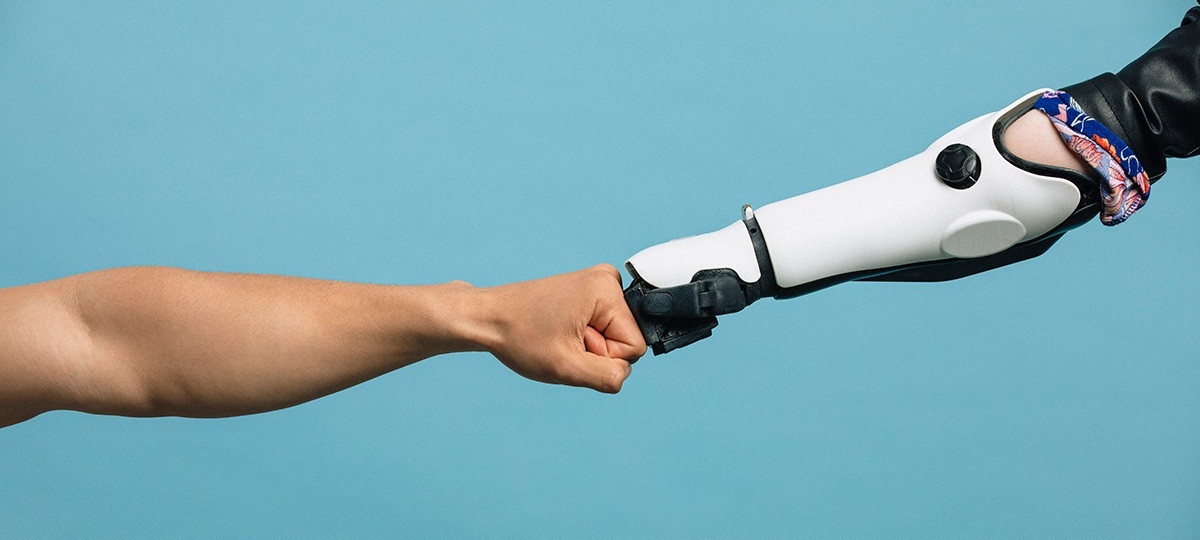

The exploding popularity of programs like ChatGPT has organizations looking closely at how artificial intelligence can be adopted in the workplace, and new School of Management research reveals that getting employees to use AI depends on two factors: employee attitudes toward the technology and the degree to which they can choose to work with it.

Published in Group & Organizational Management, the study looked at employees with both positive and negative attitudes about AI, and whether management gave them a choice in using it to see how that affected their team collaboration.

The researchers found when AI is viewed positively by the team, forcing them to use it actually suppresses collaboration. Conversely, when a team has negative attitudes toward AI, mandatory use increases team collaboration.

“This asymmetry has to do with the fact that taking away a team’s autonomy made those who were open to AI more resistant,” says the study’s lead author, Kate Bezrukova, chair and associate professor of organization and human resources. “On the other hand, when teams already had a negative attitude toward AI, a push from management actually helped.”

Using an integrative review, the researchers analyzed papers from across social psychology, information systems, engineering and other disciplines to create a team-level conceptual framework. The articles included research on a wide range of AI uses, including helping doctors diagnose illnesses, scheduling, and even for rescue missions using robot dogs.

The researchers say their findings show the importance of managing team attitudes and how developing strategies that give employees the discretion to work with AI will help optimize collaboration.

“The answer to the question about people collaborating with AI is more nuanced than simply, ‘Will they or won’t they?’” Bezrukova says. “Managers should be aware of a variety of responses when AI is introduced into the workplace.”

Bezrukova collaborated on the study with Terri Griffith, professor of innovation and entrepreneurship, Simon Fraser University Beedie School of Business; Vincent Rice, UB School of Management doctoral student; Chester Spell, professor of management, Rutgers University School of Business, Camden; and Evangeline Yang, PhD ’22, assistant professor, IÉSEG School of Management.

How to optimize recycled content in products

Vedantam

Iyer

As municipalities launch lofty environmental initiatives such as New York City’s goal of sending zero waste to landfill by 2030, School of Management researchers have developed a new model that optimizes the costs and benefits of using recycled materials in manufacturing.

Published in the European Journal of Operational Research, the model provides a framework for manufacturers to find the optimal recycled content claim given the sourcing and inventory costs of post-consumer content.

“When you pick up a coffee cup and see a message about its post-consumer content, that’s an incentive that drives demand because the consumer looks at it and says ‘Well, that’s a greener product so I’m going to buy it’,” says the study’s lead author Ananth Iyer, professor and dean of the School of Management. “But there isn’t a reliable supply of recycled materials, and using recycled content can be more expensive than using new materials, so manufacturers need to find the balance.”

To develop the model, the researchers studied the European production of glass wool, an insulation produced from a mix of natural sand and recycled glass. They focused on Europe because there is a large amount of data on the recycling rates of each nation and recycling rates are high, but the logistics of moving consumer waste between countries is a challenge.

The study found that manufacturers can increase their recycled content claims when they use a shorter time period for strategic planning, but attempts to create artificial demand for recycled products without a stabilized, reliable supply of recycled materials can decrease those claims.

The researchers say finding market-based incentives like recycled content claims are key to preventing landfills from reaching capacity.

“We have all this post-consumer waste in the U.S. with no overseas markets, so we need to find domestic solutions for this recycled material to avoid diverting it to landfill,” says study co-author Aditya Vedantam, assistant professor of operations management and strategy. “Voluntary approaches can work if you provide manufacturers with the right incentives, such as making it cheaper to collect recyclables, or creating demand-side incentives by encouraging greener procurement.”

Photo courtesy of NYSE Group

Not so fast, robots: Humans are still the best stock traders

Roesch

Algorithms have increasingly replaced stock traders over the past few decades, but a new School of Management study has found that market quality decreases when humans are removed from the equation.

Published in the Journal of Finance, the study analyzed how the New York Stock Exchange was affected after floor trading was suspended in 2020 due to the COVID-19 pandemic. Of the 13 registered exchanges in the U.S., only the NYSE continues to use human floor traders — the rest are 100% electronic.

“Given the increasing popularity of algorithms, and the growing belief that artificial intelligence will disrupt labor markets, many have argued that floor traders are no longer necessary,” says study co-author Dominik Roesch, associate professor of finance. “But the closure of the NYSE trading floor due to COVID led to worse market quality across a variety of measures, including liquidity, price efficiency and auction quality.”

To examine the impact of floor traders on NYSE market quality, the researchers combined data from the Center for Research in Security Prices with the NYSE Trades and Quotes database. Using this data, they examined the relation between floor trading and various measures of market quality in a difference-in-differences framework — comparing the quality of NYSE stocks both before and after the suspension of floor trading, and comparing NYSE stocks to their equals on the NASDAQ exchange.

Their results show pricing errors for NYSE stocks increase by 2 to 6% after floor trading is removed, illustrating how humans continue to be valuable even in the age of algorithmic trading.

“Our results show floor traders are important contributors to market quality for two reasons,” says Roesch. “First, the floor facilitates the transfer of information in a way that electronic trading cannot, and second, clients can give brokers some latitude to work on their behalf when buying and selling, which improves outcomes.”